As China’s biggest bank, ICBC has a comprehensive understanding of China’s economy, businesses and people, which is an invaluable asset that would take most international banks years to develop. With this unique understanding, an abundance of capital, and an aggressive global expansion strategy, ICBC could be not just the biggest bank in the world but also the best.

Helping China to lead the world to a zero emissions future

Being largely owned by the Chinese government (66%), ICBC’s expansion strategy captures large trends of strategic importance to the broader Chinese government’s commitments and operations.

The most important of these is the commitment to achieving net-zero emissions by 2060.

On 22 September 2020, President Xi Jinping announced in a video addressed to the UN general assembly that China would aim to become “carbon neutral” before 2060 – Beijing’s first long-term target. Japan and South Korea immediately followed China’s announcement with similar pledges. In doing so, it joins the European Union, the UK and dozens of other countries in adopting mid-century climate targets, as called for by the Paris agreement.

In a more recent announcement during the United Nations General Assembly, exactly one year later, on 22 September 2021, President Xi Jinping pledged that China would not build new coal-fired power projects abroad to add to pledges to deal with climate change, and would step up support for other developing countries in developing green and low carbon energy.

The Covid-19 response

China’s banks have been called on to help stimulate the Chinese economy as the country recovers from the Covid-19 pandemic. Along with other government policies, they have a huge role to play in effectively directing resources to putting people’s health first, and creating resilience for future crises, such as the climate emergency or pandemics, in China and beyond. So, effectively, China’s banks not only have an opportunity to make the right choice, but a profitable one as well.

ICBC set up the strategic goal to “build an international leading green bank with a high international reputation.” “We continued advocating green finance and pursuing green development to promote harmony between man and nature.” The chairman of ICBC, Chen Siqing said. “As a strong supporter of green and inclusive finance, ICBC takes pride in joining the international efforts towards the achievement of SDGs.” Gu Shu, president and executive director of ICBC shared.

ICBC and coal financing

ICBC’s record on coal financing is one of the worst among the largest banks in the world, according to the recent ranking by BankTrack.

ICBC is one of the world’s largest financiers of the top 30 coal power companies. During 2016-2020, this amounted to US $22,372 billion. During 2016-2020, ICBC provided $6,604 billion to the top 30 coal mining companies.

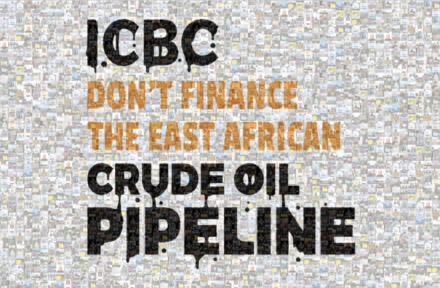

ICBC is connected to numerous controversial projects like Dakota Access in the US, Bengkulu Power Station in Indonesia, Mozambique LNG, and Vaca Muerta in Argentina. However, coal financing is where its activities have the most significant impact on climate and where they need to feel more pressure.

They also scored zero for their climate policies in the Banking on Climate change report.

Despite this, ICBC prides itself as China’s green finance leader.

Along with its ambitious expansion, ICBC invests and finances more than 30 renewable energy projects across the globe.

- In 2014, ICBC was selected as a member of the core group of the United Nations Environment Program Finance Initiative (UNEP FI) in developing a set of Principles for Sustainable Global Banking.

- ICBC was the first Chinese bank to join the TCFD and a founding signatory to the Principles for Responsible Banking, Chinese green finance framework: GIP, Green Credit Guidelines

- ICBC has also committed to abiding by Equator Principles.

- ICBC’s loans to renewable energy such as hydropower, wind, and solar accounts for around 60% of loans for the electric sector, and 77% of the increase in electricity loans over the past three years has gone to renewable energy.

Though the PRB and TCFD initiatives call for businesses to align with the Paris Agreement and the UN’s Sustainable Development Goals, ICBC has not used these platforms to draw red lines about what it won’t finance. By moving away from coal it will increase the world’s chance of achieving the Paris Agreement targets and decrease stress on the financial system. If ICBC fails to act, they will fail the people that the principles of the agreement seek to protect.

All of these initiatives demonstrate that the bank cares about its global reputation along with climate-related risks.

ICBC’s international reach

ICBC has more than 400 overseas subsidiaries and 131 branches in 21 Belt and Road countries and regions.

In 2007, ICBC bought a 20% stake in Standard Bank Group. The same year, it acquired 90% of Bank Halim Indonesia and 79.9% of Seng Heng Bank in Macau. In 2012, ICBC bought an 80% interest in the Bank of East Asia (USA). Later, it bought Standard Bank’s London-based global markets division and Argentina operations, as well.

By the end of 2018, ICBC had established 428 institutions in 48 countries and regions.

Although ICBC is largely owned by the Chinese government, it does have a large portion of international investors

So, what do we want?

The recent commitment from China shows that ICBC cannot delay any longer to change its internal policies and need to stop urgently its investments in coal. To support the implementation of China’s pledge in practical terms, banks that finance coal projects like ICBC must align with the government’s climate ambitions immediately.

Over 130 globally significant financial institutions including Japanese, South Korean, Singaporean and Malaysian banks have committed to ending finance for new coal projects. As one of the world’s largest banks and as a leader in sustainable finance, ICBC needs to get in line with its peers and make a commitment to stop funding new coal projects.

In 2019, ICBC increased green credit by $17.5 billion (2019 CSR report), comparably, ICBC invested $8.476 billion in the fossil fuel sector in 2019 (RAN’s Banking on Climate Chaos 2021 report, p.20); during 2018-2019, ICBC led to underwriting 12 green bonds, with total proceeds of $ 15.3 billion (2018, 2019 CSR reports), while through bonds underwriting, ICBC helped channel $37.291 billion (RAN’s Banking on Climate Chaos 2021 report, p.20) to the coal industry last two years.

But ICBC could be a real catalyst for global energy transition if it shored up its considerable resources behind a push for:

- A real low carbon transition/fossil fuel phase-out that excludes not only coal but other fossil fuels including all hydrocarbons. Green development would imply emission reductions as well as not creating new dependencies on fossil fuel infrastructure such as energy imports.

- Becoming a benchmark financial actor by leading on closing loopholes that allow coal companies to reach financing through lending to corporations.

- Working with local communities, securing local participation, justice and equity for those being impacted by the projects in question.